IRS 433-D 2024-2025 free printable template

Show details

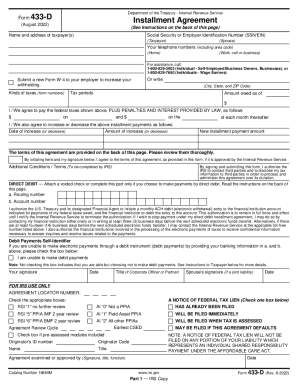

FormDepartment of the Treasury Internal Revenue Service433DInstallment Agreement(July 2024)(See Instructions on the back of this page)Name and address of taxpayer(s)Social Security or Employer Identification

pdfFiller is not affiliated with IRS

The IRS Form 433-D 2025: instructions and help

How to edit the IRS Form 433-D online with pdfFiller

How to fill out the IRS Form 433-D online in PDF format

Video instructions: completing your IRS Form 433-D

The IRS Form 433-D 2025: instructions and help

Discover everything you need to know about filling out and filing the form to request a monthly payment plan for your tax liabilities. The online filling options make it easy to complete the tax form 433-D.

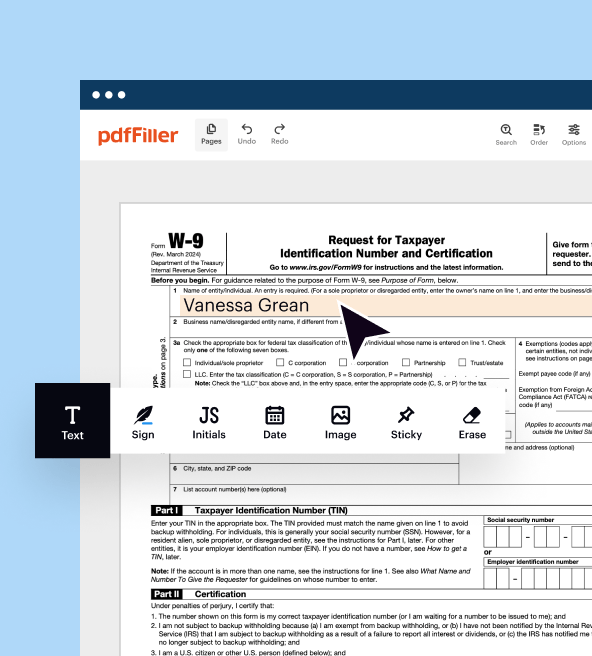

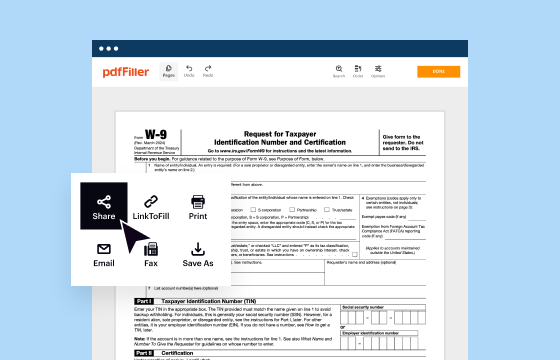

How to edit the IRS Form 433-D online with pdfFiller

With our intuitive online editor, completing the Internal Revenue Service Form 433-D goes with no complications. Here are your 8 simple steps:

01

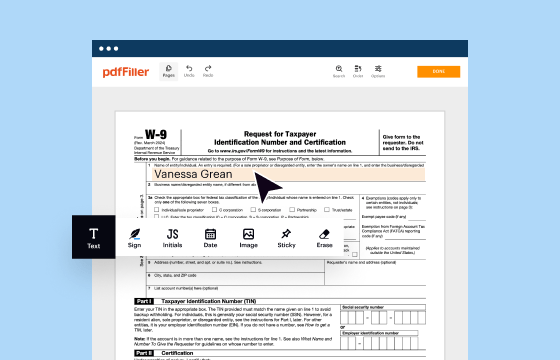

Click the orange Get Form button on this page and open the tax form 433-D in the editor.

02

Fill out the required fillable fields with pdfFiller’s editing tools.

03

If necessary, protect your completed PDF document with watermarks.

04

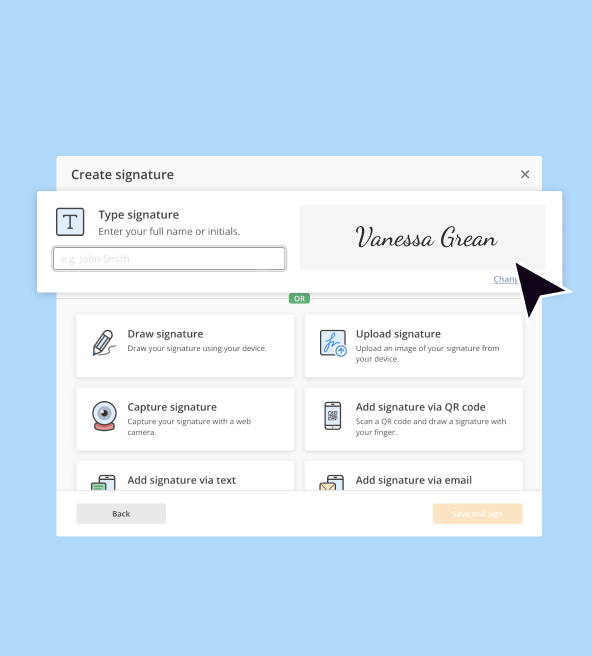

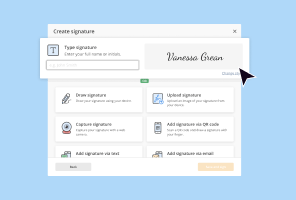

Click Sign to draw your electronic signature or upload its image.

05

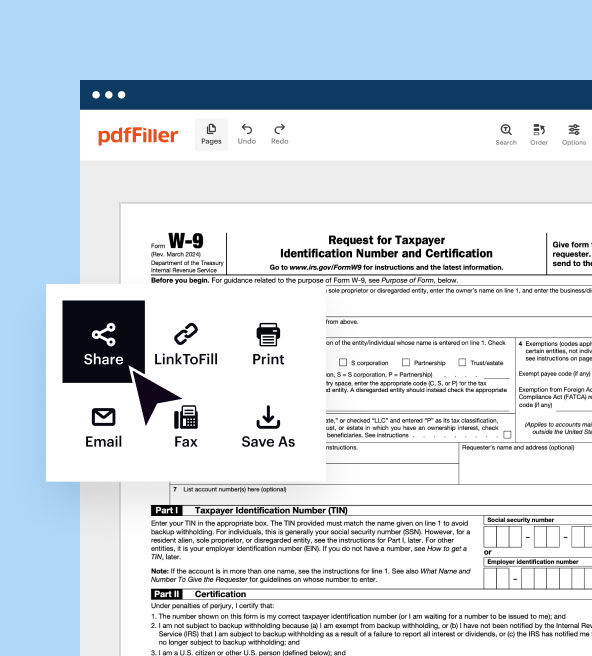

Click Done when finished to save all the changes in the file.

06

Сreate an account with pdfFiller and start a 30-day free trial to get your form 433-D, download, or export it.

07

Use the Submit to IRS option to submit the online report directly to the Internal Revenue Service.

08

To get a paper version, print the PDF file and send it by mail. Or, use our convenient Mail by USPS option.

How to fill out the IRS Form 433-D online in PDF format

Here's a step-by-step guide on how to fill out the IRS Form 433-D online:

01

Get the blank document: Visit the IRS website, navigate to the section with Form 433-D, download it, and prepare for electronic completion.

02

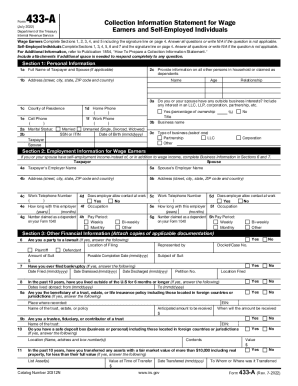

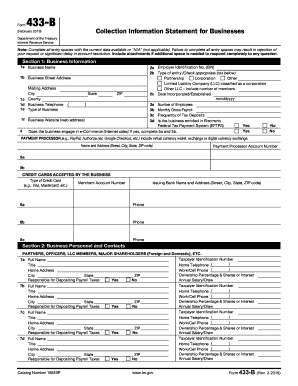

Enter Taxpayer Information: Fill in your name and address. Include your spouse’s name if filing jointly. Enter your SSN, ITIN, or EIN as applicable. Provide your home and work telephone numbers.

03

Define tax periods and liabilities: Specify the tax periods and types of taxes (e.g., income, business) associated with your liability. Enter the total amount you owe, including penalties and interest.

04

Set up payment agreement: State the initial partial payment you can make. Specify the amount you can pay each month. Choose a consistent payment due date each month from the 1st to the 28th.

05

Agree to Terms: Review the terms of the agreement carefully before proceeding. Initial in the designated area to indicate agreement to terms if the Internal Revenue Service approves.

06

Fill in the Direct Debit section (if chosen): Attach a voided check or fill out Line A with your bank's routing number and Line B with your bank account number. Confirm that direct debit is available with your financial institution.

07

Sign and date the document: Include your signature and date. If filing jointly, ensure your spouse also signs. If you are a corporate officer or partner, include your title.

08

Complete the submission: Submit the report online if available, or print and mail it to the Internal Revenue Service address that accompanied your form or specified in the "For assistance" box.

09

Pay attention to Additional Requirements and Notices: Be aware that the Internal Revenue Service may file a Notice of Federal Tax Lien.

Video instructions: completing your IRS Form 433-D

Show more

Show less

Updates to completion of the IRS Form 433-D

Updates to completion of the IRS Form 433-D

The latest review of the IRS Form 433-D was held in July 2024. Here’s the list of the main updates:

01

Understanding user fees: Revised user fees are $178 for non-Direct Debit agreements and $107 for Direct Debit agreements.

- For low-income taxpayers (at or below 250% of federal poverty guidelines), the user fee is reduced to $43, with potential waivers for electronic payments through a Direct Debit.

- A reinstatement fee of $89 for defaulted agreements, with a reduced fee of $43 for low-income taxpayers and potential waivers for electronic payments.

- For low-income taxpayers (at or below 250% of federal poverty guidelines), the user fee is reduced to $43, with potential waivers for electronic payments through a Direct Debit.

- A reinstatement fee of $89 for defaulted agreements, with a reduced fee of $43 for low-income taxpayers and potential waivers for electronic payments.

02

Direct debit instructions: Detailed guidance on setting up a direct debit, including specific routing number requirements.

03

Electronic payment options: Updated information on making voluntary payments electronically is available at www.IRS.gov/Payments.

General facts you should know about the IRS Form 433-D

What is the IRS Form 433-D?

Who needs the Form 433-D?

When is the IRS Form 433-D due to the IRS in 2025?

Do any other documents accompany the IRS Form 433-D?

What information do I include in the Form 433-D?

Where do I send the Form 433-D?

General facts you should know about the IRS Form 433-D

Find the explanation and main points about the IRS Form 433-D below.

What is the IRS Form 433-D?

The IRS Form 433-D is an Installment Agreement used by taxpayers to arrange a payment plan with the Internal Revenue Service for federal taxes owed, including any penalties and interest. It allows individuals and businesses to pay the amount due monthly over a specific period.

Who needs the Form 433-D?

Taxpayers who are unable to pay their full tax liability immediately and wish to establish an installment payment plan with the Internal Revenue Service need to fill out Form 433-D. This includes individuals, self-employed persons, business owners, and those filing jointly.

When is the IRS Form 433-D due to the IRS in 2025?

The document itself does not have a specific due date but should be submitted as soon as an installment agreement is needed to prevent penalties or enforced collection actions. Monthly payments must be received by the due date chosen by the taxpayer, ranging from the 1st to the 28th of each month.

Do any other documents accompany the IRS Form 433-D?

If selecting the Direct Debit option, a voided check must accompany the form. Additionally, taxpayers may need to provide updated financial information if the Internal Revenue Service requests to assess or modify the agreement.

What information do I include in the Form 433-D?

Include the taxpayer's name and address, SSN/ITIN/EIN, contact numbers, tax periods, types and amounts of taxes owed, and proposed installment payment amounts. For Direct Debit, include banking information (routing and account numbers).

Where do I send the Form 433-D?

The completed Form 433-D should be returned to the Internal Revenue Service address specified on the accompanying letter or in the 'For assistance' box on the front of the PDF file. For additional assistance, taxpayers can contact the numbers provided in the document on the IRS website.

Show more

Show less

FAQ

What is the purpose of the IRS Form 433-D?

The primary purpose of Form 433-D is to allow taxpayers to establish an installment agreement with the Internal Revenue Service for paying federal taxes owed over time, including any applicable penalties and interest.

How do I decide the monthly payment amount on Form 433-D?

You should propose an amount based on your current financial situation, considering how much you can afford to pay each month without causing financial hardship. If you don't list a payment amount for the agreement, the IRS personnel will determine the amount by dividing what you owe by 72 months.

Can I change the payment amounts after the agreement is in place?

Yes, you can request to increase or decrease your installment payments by specifying new amounts and dates on the document, but such changes might need approval from the IRS.

What is the advantage of using Direct Debit for installment payments?

With Direct Debit, your monthly payment is automatically withdrawn from your bank account, ensuring timely payments and reducing the risk of missing a due date. Additionally, the user fee for Direct Debit agreements is lower than for non-Direct Debit agreements.

Is there a fee to set up an installment agreement using Form 433-D?

Yes, there is a setup fee: $178 for non-Direct Debit agreements and $107 for Direct Debit agreements. Low-income taxpayers might be eligible for a reduced fee of $43, which could be waived under specific conditions.

What happens if I default on my installment agreement?

If you default, the IRS may charge a reinstatement fee of $89, pursue collection actions like levies on income or bank accounts, and possibly terminate the installment agreement, requiring full payment of the remaining balance.

Do I need to provide a voided check with Form 433-D?

A voided check is necessary only if you opt for the Direct Debit payment method. This check provides the IRS with the required bank routing and account numbers for electronic withdrawals.

How does the IRS use the information provided in Form 433-D?

By signing Form 433-D, you authorize the Internal Revenue Service to contact third parties and disclose tax information as necessary to process and administer the agreement. The report also ensures that payments are effectively applied towards your tax liabilities.

Our user reviews speak for themselves

Let the tax year 2025 be the time you simply and timely get your taxes in order with pdfFiller! Our customers have had nothing but positive experiences to share.

Great, Especially for do it yourself. Love it

Seems like a great program but not user friendly when trying to self-teach

Fill out IRS Form 433-D

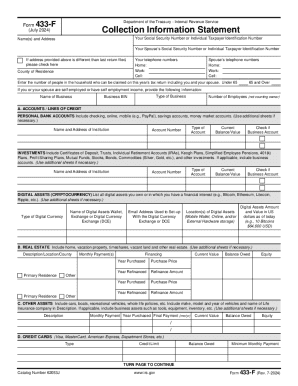

Forms related to the IRS Form 433-D

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.